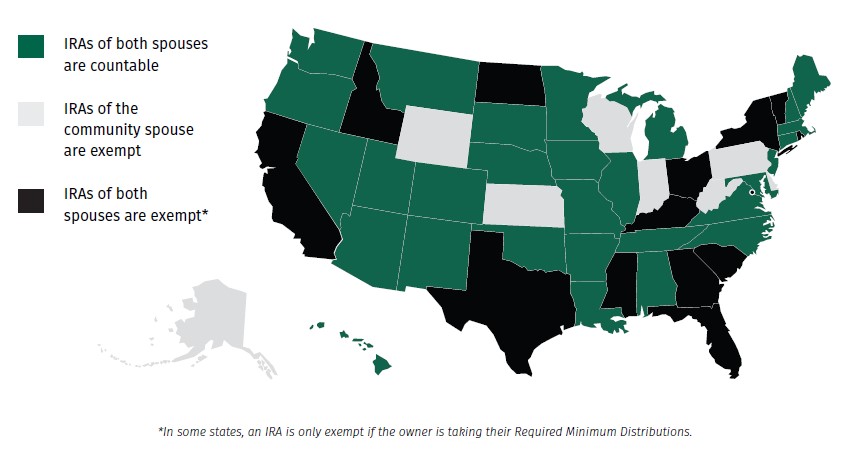

As a financial professional working with seniors, it’s essential to understand how individual retirement accounts (IRAs) are treated when applying for Medicaid. The rules vary by state, but depending on where your client resides, IRAs—whether owned by the institutionalized person or their spouse—could be classified as either countable or exempt assets. This distinction plays a crucial role in Medicaid eligibility.

Fortunately, if an IRA is treated as a countable asset in your client’s state, there’s a powerful planning option: transferring IRA funds into a Medicaid Compliant Annuity (MCA). This strategy allows your clients to spend down their assets and convert the funds into income, thereby preserving their Medicaid eligibility.

Read More: Can You Give Away Assets to Qualify for Medicaid?

IRA Treatment as Countable or Exempt by State

Tax Consequences of Liquidating an IRA

Liquidating a traditional IRA to spend down for Medicaid purposes can have severe tax implications. Since traditional IRAs consist of pre-tax funds, withdrawing these funds triggers taxable income, which can escalate your client’s overall tax liability in the following ways:

- All withdrawals are taxed in the year they are received.

- The account holder may be subject to a higher income tax bracket.

- If a married couple’s income exceeds $44,000 annually, up to 85% of their Social Security benefits could become taxable.

- Exceeding income thresholds (e.g., $206,000 in 2024) may increase Medicare Part B and Part D premiums.

These considerations make liquidating an IRA a less appealing option, particularly when advisors can recommend more tax-efficient strategies, such as transferring funds into a Medicaid Compliant Annuity.

Using an MCA to Spend Down IRA Assets

For clients whose IRAs are considered countable assets for Medicaid purposes, transferring IRA funds into an MCA can preserve the funds from being counted in Medicaid eligibility determinations. This process can be done through a Trustee-to-Trustee Transfer or a 60-Day Rollover.

Trustee-to-Trustee Transfer

- The transfer occurs directly between financial institutions, keeping the funds tax-deferred.

- No immediate tax reporting (no 1099 R or Form 5498) is required.

- The ownership of the IRA remains the same, ensuring no tax implications.

- This method has no time limit but may take longer to complete (4–6 weeks).

60-Day Rollover

- In this case, the client receives a check from their IRA custodian and must reinvest the funds into an MCA within 60 days to avoid tax consequences.

- The client will receive a 1099-R and must ensure the rollover complies with tax regulations.

- This method offers a shorter completion time but limits the client to one rollover every 365 days.

Spreading Out Tax Consequences with an MCA

A key benefit of using an MCA in this scenario is that it allows your client to spread out the tax liability over the life of the annuity. Instead of triggering a large taxable event by withdrawing the entire IRA balance at once, clients can receive annuity payments over time, with taxes assessed only as payments are made in each calendar year. The longer the annuity term, the more beneficial this can be for reducing the client’s annual tax burden.

Why MCAs Are a Smart Option for Medicaid Planning

For clients looking to preserve their wealth while qualifying for Medicaid, transferring IRA funds to an MCA is an excellent solution. Not only does this approach help meet spend-down requirements, but it also provides a structured income stream for the client. By using MCAs, agents and advisors can help clients avoid steep tax penalties, maintain Medicaid eligibility, and manage their long-term care planning more effectively.

Read More: What Is the “Name on the Check Rule” MCA Strategy?

As a financial professional, ensuring that your clients understand these strategies can help them navigate the complexities of Medicaid planning and protect their financial future. If you have questions about using MCAs for your clients or need assistance with state-specific Medicaid rules, don’t hesitate to reach out to our team.