Many married couples who are looking to qualify for Medicaid are concerned about the financial well-being of the healthy spouse. To combat this concern, the Medicaid program contains certain standards to prevent spousal impoverishment and allow the spouse at home to maintain their current lifestyle within the community. This includes the Community Spouse Resource Allowance.

Click here to view your state’s Medicaid figures.

Medicaid Resource Allowance for a Married Couple

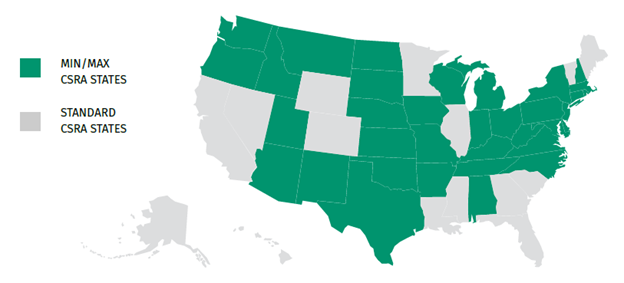

While the institutionalized spouse can keep an Individual Resource Allowance of $2,000 (in most states), the community spouse is entitled to retain a separate amount known as the Community Spouse Resource Allowance (CSRA). Some states apply a standard CSRA, while others use a minimum and maximum allowance.

Standard CSRA Calculation

In standard CSRA states, the community spouse must simply have fewer assets than the CSRA in order to qualify the institutionalized spouse for Medicaid. The allowance varies by state and is typically updated annually. For example, if the CSRA is $154,140, the community spouse must spend down their countable assets to be below that limit.

Read More: How to Spend Down Assets for Medicaid

Minimum/Maximum CSRA Calculation

In minimum/maximum CSRA states, the community spouse is entitled to one-half of the couple’s assets as of the snapshot date, not to exceed the maximum CSRA and not to fall below the minimum. The minimum and maximum allowances vary by state and are typically updated annually.

To calculate the CSRA in a minimum/maximum CSRA state, you first need to determine the snapshot date, which is the first date that the Medicaid applicant was institutionalized for 30 consecutive days. Then, take the couple’s total countable assets on that date and divide it in half.

Example: John and Penny are married, and John enters a nursing home on April 1, 2024. As of that date, the couple’s total countable assets were $350,000. A month later, on May 1, the couple decided to apply John for Medicaid. How much can Penny keep as her CSRA while still qualifying John for benefits?

To calculate Penny’s CSRA, start by dividing the couple’s total countable assets in half: $350,000 ÷ 2 = $175,000

- If the resulting figure exceeds the maximum CSRA of $154,140, the community spouse can keep the maximum CSRA.

- If the resulting figure is between the minimum and maximum CSRA, the community spouse can keep that amount.

- If the resulting figure is less than the minimum CSRA of $30,828, the community spouse can keep the minimum CSRA.

Since the resulting figure is more than the maximum CSRA, Penny can keep the maximum CSRA of $154,140.

Read More: Can You Give Away Assets to Qualify for Medicaid?

Keeping Assets Beyond the CSRA

Although the community spouse must initially spend down to be within their CSRA, once eligibility is achieved, Medicaid will no longer consider any of the community spouse’s assets as available to the institutionalized spouse. This means the community spouse can retain assets in excess of the CSRA after the institutionalized spouse begins receiving benefits.

If you have any questions regarding Medicaid’s spousal impoverishment standards or calculating the CSRA, please contact our team!