Disclaimer: Since Medicaid rules and insurance regulations are updated regularly, past blog posts may not present the most accurate or relevant data. Please contact our office for up-to-date information, strategies, and guidance.

When it comes to achieving eligibility for Medicaid, some clients may not realize that in addition to certain resource limitations, they may also need to comply with income restrictions as well. These income cap restrictions could result in your client being required to establish a Qualified Income Trust.

1. When is a QIT needed?

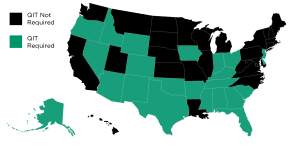

A Qualified Income Trust (QIT) is required in those states that impose an income cap on a Medicaid applicant’s monthly income. These states require that any amount of the applicant’s monthly income that exceeds the established income cap, must pass through the QIT. For 2022, that standard figure is $2,523.00 in most states[1].

2. What is a QIT?

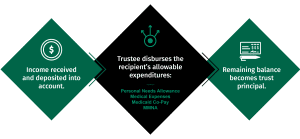

The QIT, or sometimes referred to as a Miller Trust, is an irrevocable, income-only trust that holds the income of the Medicaid applicant. The trust functions as a flow-through entity allowing the applicant’s income that exceeds the income cap, to be deposited into the QIT and used for allowable medical expenses.

3. How does the QIT work?

Once the Medicaid recipient’s monthly income has been deposited into the trust, the trustee can then withdraw those funds to pay for the recipient’s medical expenses and allowable deductions.

4. Who are the parties to the QIT?

In order to be accepted by Medicaid, the QIT must designate the appropriate individual as each respective party to the trust as follows:

- Settlor/Grantor

- Trustee

- Lifetime Beneficiary

- Primary Beneficiary

- Secondary Beneficiary

5. Where do I establish the QIT account?

Following the signing and execution of the trust documents, your client will need to establish a trust checking account with their local bank in order to fund the QIT. The trust checking account should typically be titled similarly to the name of the trust itself such as “Qualified Income Trust of [recipient’s name].”

Once the trust checking account has been established, your client will need to submit a copy of the properly executed trust document, trust checking account information and proof that arrangements have been made to deposit income into the trust on a monthly basis to Medicaid. We recommend working with an elder law attorney to submit the Medicaid application and supporting documentation.

To learn more about establishing a QIT for your client, contact our office at 800-255-1932 and ask to speak with one of our knowledgeable Benefits Planners.

[1] Delaware is the exception to this standard figure with the income cap for 2022 being $2,102.50.